Open Business Checking Account Online Navy Federal

You ll also have to deposit 100 in the business account at the time of opening.

Open business checking account online navy federal. 2 members with free active duty checking accounts will receive their direct deposit of net pay ddnp one business day early. Fees may reduce earnings. 1 up to 20 00 in atm fee rebates per statement period. First 100 free then 40 cents per transaction.

1 as of 5 1 20 rates range from 9 15 apr to 18 apr are based on creditworthiness and will vary with the market based on the wall street journal prime rate. None if performed at a navy federal branch or atm. 1 non electronic transactions are defined as checks processed and in branch transfers deposits and withdrawals. Up to 12 checks for deposit at a branch will count as one transaction.

This means that you ll first need to be an individual member with an account in good standing. 3 monthly service fee waived if average daily balance is 5 000 or more. 15 if you don t maintain a minimum balance of 1 500 or link your total business checking account to a chase private client checking or chase premier platinum checking account. Each transaction thereafter will cost 25 cents.

2 rates on variable rate accounts could change after account opening. Think of these accounts as essential tools to help your small business grow and thrive. Open a business account when you re ready to start accepting or spending money as your business. 5 for flagship checking no monthly service.

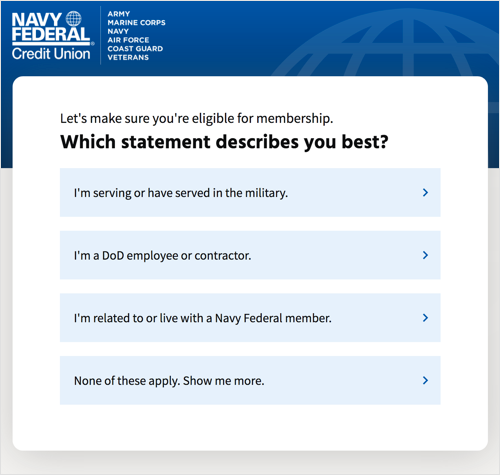

For business membership eligibility all owner s of the business must have an existing individual membership with navy federal. 4 up to 10 in atm fee rebates per statement period. 12 if you fail to maintain a 1 500 balance but opt for electronic statements transaction fee. Atm cash advance fees.

Otherwise 0 50 per domestic transaction or 1 00 per foreign transaction. Business checking accounts include the first 30 transactions for free. Building blocks for your business. A business bank account helps you stay legally compliant and protected.

To open a navy federal business checking account you ll need to have business membership of the credit union. Business checking and savings. Your account comes with a navy federal debit card the combination debit and atm card that s accepted worldwide at millions of locations. This is not required for sole proprietorships.

Offering rates may change. You ll receive your starter checks in 7 to 10 business days. The best part is that all accounts earn dividends. It also provides benefits to your customers and employees.

Choose the right checking account for me. Direct deposit required to receive atm fee rebates for flagship checking. 3 up to 10 per statement period. Open a checking account online.

:max_bytes(150000):strip_icc()/navy_federal_credit_union_3x1_FINAL-5c5457bc46e0fb00013fac0a.png)